Register for free and continue reading

Join our growing army of changemakers and get unlimited access to our premium content

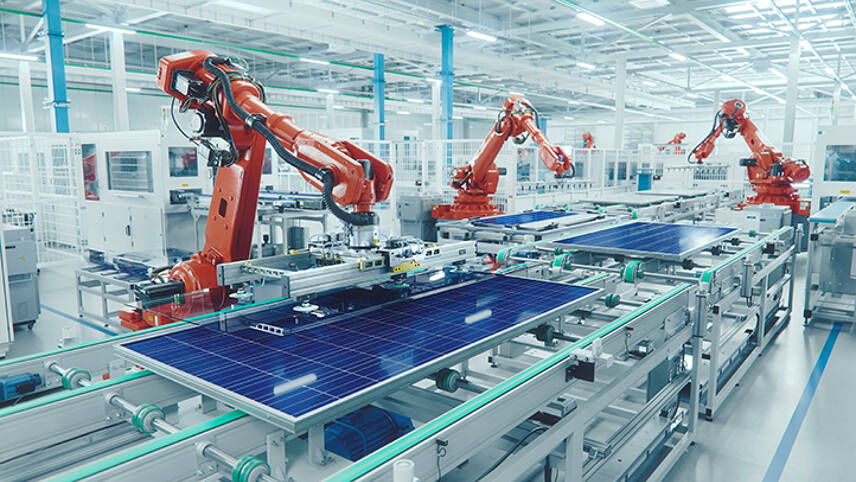

The IEA’s Energy Technology Perspectives 2023 was published this morning (12 January), acting as a guidebook for key clean technology industries such as solar panels, wind turbines, electric vehicle (EV) batteries, electrolysers for hydrogen and heat pumps.

The report claims that the energy world is entering “the age of clean energy technology manufacturing” that can create major new markets worth billions while also creating millions of green jobs.

The report finds that the global market for manufactured clean energy technologies will be worth around $650bn annually by 2030 – more than three times greater than current levels. This depends on countries fully implementing current energy and climate pledges.

The report also states that delivering on these commitments would see clean energy manufacturing jobs more than double to 14 million by 2030.

“The IEA highlighted almost two years ago that a new global energy economy was emerging rapidly. Today, it has become a central pillar of economic strategy and every country needs to identify how it can benefit from the opportunities and navigate the challenges. We’re talking about new clean energy technology markets worth hundreds of billions of dollars as well as millions of new jobs,” said IEA’s executive director Fatih Birol.

“The encouraging news is the global project pipeline for clean energy technology manufacturing is large and growing. If everything announced as of today gets built, the investment flowing into manufacturing clean energy technologies would provide two-thirds of what is needed in a pathway to net zero emissions. The current momentum is moving us closer to meeting our international energy and climate goals – and there is almost certainly more to come.”

The report adds that clean energy technologies will benefit from short lead times of around 1-3 years, which will enable the project pipeline to expand rapidly should more ambitious national pledges be introduced.

The IEA states that only 25% of the announced manufacturing projects globally for solar PV are under construction, for example, while 35% of projects are starting imminently or under construction for EV batteries and less than 10% for electrolysers.

Risk and reward

The report does note that this new industrial era is rife with risk.

The IEA warns that current supply chains for clean energy technologies are at risk due to “high geographic concentrations” of resource mining, processing and technology manufacturing.

The IEA states that “greater efforts are needed to diversify and strengthen clean energy supply chains,” with China accounting for the bulk of manufacturing capacity expansion plans. Indeed, China will likely account for around for 85% of planned manufacturing expansion for solar cells and modules and 85% for wind turbine blades. This rises to 98% for EV battery components like anodes.

Additionally, the Democratic Republic of Congo produces more than 70% of the world’s cobalt, and just three countries – Australia, Chile and China – account for more than 90% of global lithium production. The report warns that these levels of concentration make entire supply chains vulnerable to policy and corporate decisions or natural events.

The report also notes that while expansion is happening rapidly, this is pushing up the prices for key components. Cobalt, lithium and nickel have all increased in price and caused average EV battery costs to jump 10% globally last year. The cost of wind turbines outside China has also been rising after years of declines, and similar trends can be seen in solar PV.

The report urges nations to set enabling policies that support investment into these sectors, but calls on nations to “play to their strengths” by deciding whether mineral resources, low-cost clean energy supplies, a workforce with relevant skills, or synergies with existing industries are key enablers for growth, rather than all of them.

The report also welcomes new flagship policies that will help drive the market in the near term. The Inflation Reduction Act in the US is a package of measures to help vulnerable people pay for health care and to reduce emissions, with a focus on energy and transport. Elsewhere, the Fit for 55 package and REPowerEU plan in the European Union are spurring market growth, as are Japan’s Green Transformation programme, and the Production Linked Incentive scheme in India that encourages manufacturing of solar PV and batteries.

Please login or Register to leave a comment.