Register for free and continue reading

Join our growing army of changemakers and get unlimited access to our premium content

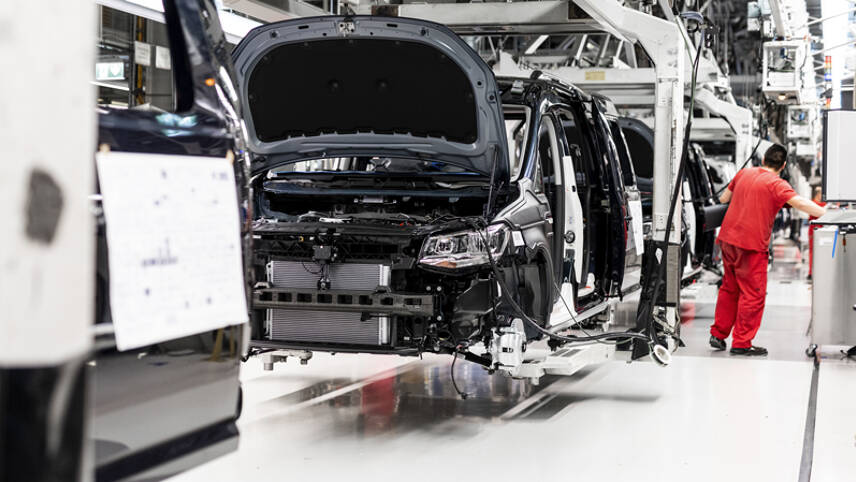

The regions want support to reskill staff and change production infrastructure amid the EV transition

The Just Transition Fund (JTF) supports the territories most affected by the transition towards climate neutrality, mostly coal regions, to avoid regional inequalities. It will provide €20bn of direct cash until 2027. Now, 20 carmaker districts from seven EU countries, assembled under the banner of the Automotive Region Alliance, are angling for something similar.

“The automotive sector in the EU accounts for over 14 million jobs. The move to zero-emission cars and vans offers opportunities for Europe’s industry, but equally clear challenges,” said EU Commissioner Nicolas Schmit during the plenary of the Committee of the Regions on Thursday (30 June).

Speaking out in support of the carmaker regions, he highlighted the need for “strong accompaniment of reskilling and job-to-job transitions” as well as “adequate funding.”

Cross-border solidarity appears to be the approach of these regions, perhaps as a way to circumvent less pliable national governments.

Regions from Germany, France, Italy, Spain, the Netherlands, Austria and Slovakia banded together to call for a “European mechanism supporting a just, fair and successful transition for the European automotive and supply industry regions” and “dedicated additional budget headings.”

The Automotive Region Alliance argues that the challenge posed by the seemingly-imminent 2035 end to the combustion engine – and thus the core business of its suppliers – will be substantial enough to justify a special support scheme.

A 2021 study estimated 5.7 million jobs spread across the core car and adjacent industries could be implicated by the EV revolution – considerably less than Schmit’s estimate of 14 million, yet sizeable nonetheless. Combustion engine-focused suppliers and so-called original equipment manufacturers (OEMs) are expected to suffer the largest job losses by far, at 220,000 and 280,000 respectively.

“The transformation is of course enormous. Especially in Baden-Württemberg and Bavaria, where the combustion engine and its suppliers represent the core business,” explained Fanny Tausendteufel, project manager of industrial policy at German transport think-tank Agora Verkehrswende.

“There will still be some challenges to overcome there due to the shift to e-car production, but also other drivers of structural change,” she added. Both regions are comparatively far behind on the roll-out of renewables.

Similar challenges will likely be faced by OEM-heavy clusters in Spain like Galicia, which is a member, and elsewhere.

But where some stand to lose out, others stand to gain. “Eastern Germany in particular will benefit from the switch to e-mobility. ‘Silicon Saxony’ will benefit from the concentration of potential suppliers for the production of e-cars there,” highlighted Tausendteufel.

Rags versus riches

Unlike the coal regions, which had necessitated EU support by virtue of their relative poverty and oftentimes economic isolation, automotive regions are some of the EU’s wealthiest.

In 2019, Baden-Württemberg, an alliance member, had a GDP per capita of €47,000 and was thus as wealthy as Australia. North Rhine-Westphalia, another alliance member, had a GDP per capita of €39,600. Saxony, the East German alliance member, is the furthest off at €31,423 per capita.

Added to the fact that most studies project a relatively insignificant job loss as of 2030, it poses the question of whether the German states should benefit from a scheme designed to help disadvantaged regions catch up.

Nikolaus J Kurmayer, EurActiv.com

This article first appeared on EurActiv.com, an edie content partner

Please login or Register to leave a comment.