Register for free and continue reading

Join our growing army of changemakers and get unlimited access to our premium content

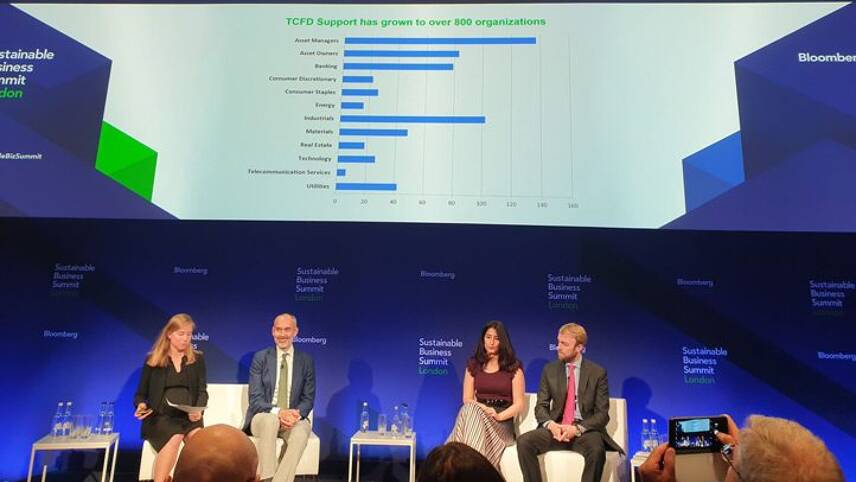

The framework was a key discussion point at Bloomberg's Sustainable Business Summit in London this week

Called the EU Taxonomy and developed by the Commission’s Technical Expert Group on Sustainable Finance (TEG), the tool enables companies and their investors to determine which economic activities that are widely considered “green” can be implemented without unintended negative consequences elsewhere in the environment or society.

It covers climate mitigation; climate adaptation; water stewardship; circular economy measures; pollution prevention and control and ecosystem protection, with an overall ambition to align disclosure, prevent greenwashing and foster systemic investment in the low-carbon economy.

The framework additionally includes a new, bloc-wide standard for issuing green bonds and a series of “minimum technical requirements” for disclosure around environmental, social and governance (ESG) factors. The latter includes a requirement for firms to disclose how their operations compare with the 2C and 1.5C trajectories laid out in the Paris Agreement.

Around 6,000 listed companies across the EU will be given access to the Taxonomy tools, which were inspired by the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) as well as the TEG. These corporates, banks and investors were selected on the basis that they are already required to disclose non-financial information under the EU’s Non-financial Reporting Directive.

The framework comes in the same week that EU leaders are due to meet to give their blessing to a proposed long-term climate strategy during a European Council summit in Brussels. Carbon-neutrality will be top of the agenda during the discussion, with 19 nations having publicly said that they will back a bloc-wide net-zero goal for 2050.

“The climate emergency leaves us with no choice but transit to a climate-neutral economy model,” the Commission’s vice president for financial sustainability, financial services and capital markets union Valdis Dombrovskis said.

“[Our] new guidelines will help companies to disclose the impact of the climate change on their business as well as the impact of their activities on climate and therefore enable investors make more informed investment decisions.”

Industry reaction

The move from the European Commission has been widely welcomed by key players across the finance industry, and by a number of corporates that the framework will cover more broadly.

However, calls are also being made for the measures to be enshrined in law through the EU’s Taxonomy Regulation – a move which can only be made through an agreement between all member states.

PwC’s sustainability and climate change partner Jon Williams said a legal requirement for unified disclosure is “now vital” to ensure that the financial system “is given the regulatory environment and encouragement needed to affect long-lasting and meaningful change”.

“It’s clear that there is strong desire in the financial services industry for a common language around sustainable finance,” Williams said. “This is partly driven by institutional investors, but also by an understanding that compliance with emerging regulatory requirements, not least the ESG Disclosure Regulation, will be enormously aided by common definitions.”

Williams’ sentiments were echoed by panellists at a discussion on climate-related disclosures at this week’s Bloomberg Sustainable Business Summit in London.

During the session on Tuesday (18 June), panellists from three major investment firms agreed that the increasing number of companies committing to disclose in line with the TCFD on a voluntary basis, coupled with a surge in environmental disclosures through platforms such as CDP, indicated that such disclosures could soon be a requirement of national law.

“We have to create a level playing field, because, right now, you are almost at a disadvantage for disclosing in that some parts of your operations are going to be seen negatively,” Legal & General Investment Management’s head of sustainability and responsible investment strategy Meryam Omi said.

UBS Wealth Management’s managing director and head of sustainable and impact investments James Purcell agreed, adding that mandatory disclosure would “undoubtedly be a good thing” which “accelerates the pathway to transparency”.

“At the minute, companies can hide behind the non-comparability of what they choose to disclose,” Purcell explained. “Having transparency and being able to make like-for-like comparisons will enable investors to see which companies are lagging and therefore creating their own businesses risks, and then, to engage and apply the appropriate pressure.”

However, the speakers also concurred that disclosure would need to be a starting point, rather than a stopping-point, in the financing of the low-carbon transition. Specifically, Omi noted that TCFD alignment would not require banks and investors to disclose the carbon impact of their energy investments and claimed that some firms are still taking a “tick-box” approach to climate issues.

“Having one item on the board, ticking it, and claiming your governance is done, is not the point of TCFD,” she said. “We need to get, quite quickly, to the point where businesses can’t get a point for simply having targets in place and disclosing them. They should be stretching, science-based and meaningful targets.”

Marsh & McLennan’s director of climate resilience Robert Bailey agreed and noted that many firms in his portfolio were “happy to go through TCFD up to a point, but reluctant to go the final stage towards disclosure”.

“Moving forward, for companies, is hard; they need data that doesn’t exist yet and are not necessarily equipped to carry out scenario analysis because they’re not sure which scenarios are the best to use,” Bailey said, urging better support from the TCFD on data challenges.

The discussion took place shortly after the TCFD revealed that it has received the backing of more than 800 companies to date. TCFD’s latest status report revealed that efforts towards disclosure have increased by 50% over the past year, but that the information given is typically not detailed enough for the purpose of investors.

Sarah George

Please login or Register to leave a comment.