Register for free and continue reading

Join our growing army of changemakers and get unlimited access to our premium content

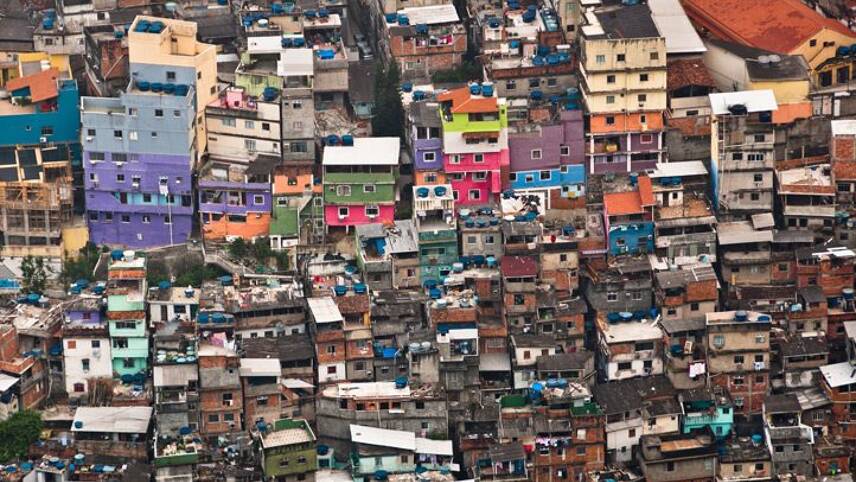

The SDG500 will focus specifically on developing nations

The SDG500 is a coalition of private and public sector organisations, including United Nations entities, non-governmental organisations and private equity firms. The investment platform will target businesses across the agriculture, finance, energy, education and healthcare sectors across Africa, Asia, Latin America, and the Caribbean and Pacific regions.

It is hoped the funds will start addressing the estimated $2.5trn annual finance gap to achieving the SDGs in developing nations. Funds will be managed by impact asset manager Bamboo Capital Partners.

Bamboo Capital Partners’ founder and managing partner Jean-Philippe de Schrevel said: “The launch of SDG500 is a unique milestone for the impact investing industry. We have never seen a coalition from the private and public sector come together to achieve the SDGs on this scale before.

“The missing middle financing gap is real, and it is suffocating early-stage enterprises which have the potential to transform some of the world’s poorest and most underdeveloped regions. We believe that by working together to finance and scale these businesses, we can achieve the SDGs and take another step closer to a better, more sustainable future for all.”

Funding gap

Despite studies suggesting that as much as $12trn and 380 million jobs could be generated by 2030 if the SDGs are placed at the heart of global economic strategies, progress against them has been slow. While the World Bank had raised €1.5bn for a new 10-year bond for the SDGs, the SDG500 will focus specifically on developing nations.

The SDG500 will offer six underlying funds aimed at addressing the “missing middle” finance gap that can impact start-ups and disruptors at a point where the original market growth becomes constrained. There will also be a focus on gender and the empowerment of women for some of the funds.

An ABC Fund will target smallholder farmers and small and medium agribusinesses in developing countries, a fixed-income BUILD fund will target early-stage enterprises in the least developed countries, while the CARE SheTrades Fund will focus on gender equality in Asia. Elsewhere BLOC SmartAfrica and BLOC Latin America will act as venture capital funds targeting technology enterprises in Africa, Latin America and the Caribbean respectively and the HEAL venture capital fund will invest in healthcare and technology businesses.

The announcement is one of many SDG-focused initiatives that have been launched at the start of 2020 – connoting a decade of deliverance to achieve the goals.

Last week, business giants such as Nando’s, Nestle, PwC have joined forces with RSPB and the WWF to launch an action plan aimed at strengthening government performance against the SDGs.

A Sustainable Development Goals Disclosure (SDGD) Recommendations report has also been released by leading accounting bodies that have called for better corporate disclose on efforts to align SDG reporting, including for organisations to disclose negative contributions in order to deliver change.

Matt Mace

Please login or Register to leave a comment.