Register for free and continue reading

Join our growing army of changemakers and get unlimited access to our premium content

Image: Parliament Live TV

Sunak delivered a statement to the House of Commons this afternoon (26 May), in which he scrapped the initial “rebate and clawback” scheme announced by the Treasury in February. Under that initial scheme, every UK household would get a £200 discount on their dual-fuel bill this year, rising to up to £500 for the lowest-income families. The discount was set to be applied in October and households mandated to pay back the money over a five-year period.

The initial scheme was widely criticized by green groups, charities and citizens’ groups, who pointed out that £200 would not go far enough. Ofgem’s energy price cap, previously set at £1,278, was increased to £1,971 in April and is set to rise again to around £2,800 in October.

Today, Sunak has increased the amount of discount available to each home and confirmed that the funding will now be in the form of a grant, which households will not have to pay back. Sunak said that the “situation has evolved and become more serious” over the course of 2022.

All homes will be eligible for a £400 grant toward their annual energy bills for 2022. More than eight million households on means-tested benefits will also receive lump-sum grant payments worth up to £650 on top of this, in a two-part payment. An additional eight million pensioners will receive a £300 lum-sum grant, and six million people on non-means-tested disability benefits will receive a lump-sum grant of £150.

The majority of the funding for these new measures will be raised using a one-off windfall tax on oil and gas majors operating in the North Sea. Profits will be taxed at a rate of 65% – up from 40% – until prices return to a “historically more normal level”. Labour has been calling for such a move for months but the Conservatives have, to date, opposed the idea, arguing that it could dampen these corporations’ investments in low-carbon energy in the UK. The Green Party and Liberal Democrats have also supported the tax.

Oil and gas majors have seen a significant increase in profits in recent months, as the rise in global gas prices, which began last summer due to discrepancies in global supply and demand, has been majorly accelerated by Russia’s invasion of Ukraine. Shell reported its highest ever quarterly profit for the first quarter of 2022, with profits tripling year-on-year to reach $9.13bn. BP also recorded profits in the first quarter of 2022 that were more than twice as high as the first quarter of 2021.

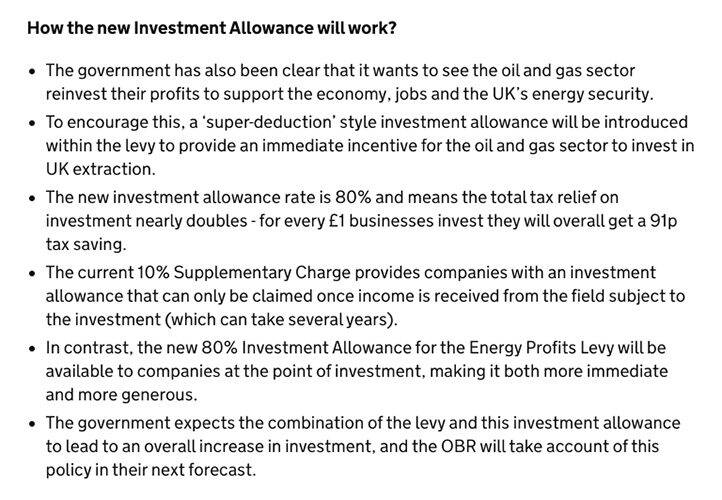

The tax is called the ‘temporary targeted energy profits levy’ and is set to come into effect in the autumn. It will have an investment allowance, similar to the super-deduction announced in spring 2021. Sunak said companies will get a total of a 90% tax relief on new investments.

Sunak expects the windfall tax to raise £5bn this year.

Ahead of Sunak’s speech, Labour leader Kier Starmer wrote on Twitter: “First, the Tories said they couldn’t introduce a windfall tax because producers were the ones struggling. They called it ‘Unconservative’. Now, Labour has dragged them kicking and screaming to this obvious solution. Why has it taken them so long while households suffered?”

Sunak told the House of Commons: “Fiscal support should be timely, temporary and targeted.

“As we support people more, we need to think about the fairest way to fund as much of that cost as possible. The oil and gas sector is making extraordinary profits, not as the result of recent changes to risk-taking, innovation or efficiency, but as the result of surging global commodity prices, driven in part by Russia’s war.

“I am sympathetic to the argument to tax those profits fairly – but, as ever, there is a sensible middle ground. We should not be ideological about this, we should be pragmatic. It is possible to both tax extraordinary profits fairly and incentivizes investment.”

Fossil fuel loopholes

The new announcement effectively boost the tax rate by 25%, from 40% to 65%. However, there is still some vague terminology around “new investment allowances” which has seen some question whether energy giants are able to bypass this windfall tax.

Under a new plan, oil and gas firms can access a “super-deduction” investment allowance which means for £1 spent in “UK extraction” up to 91% of the costs will be covered by the tax saving.

This deduction is covered from the point of investment, rather than at the point the project starts producing. Many green experts have noted that “UK extraction” is a vague term, but one that points to major tax reliefs for energy giants that invest in the extraction of more UK-based oil and gas fields.

Green energy procurement and generation are not covered under this new investment allowance, which many oil majors like BP are turning to. However, as the Climate Change Committee’s chief executive Chris Stark pointed out on Twitter, this is mainly because these firms’ renewables arms would be seen as different entities from the oil and gas portion of the business and therefore subject to different tax regimes.

As explained by Carbon Brief’s Dr Simon Evans, the windfall tax can be viewed as a “massive fossil fuel subsidy”.

The devil is in the detail. By my calculations, based on OGUK economic report, the new tax relief on oil and gas investment will mean the tax payer subsidising new investment in fossil fuels to the tune of about £5.7bn up to 2025. https://t.co/nmZqOKuFHN https://t.co/aIS2LAmRLR

— Alex Chapman (@chappersmk) May 26, 2022

A survey of 2,005 adults in the UK this month, carried out by Green Alliance, found that 63% would support a one-off windfall tax on big fossil fuel companies. Just 7% were definitely in opposition, with the remainder undecided.

Green Alliance’s executive director Shaun Spiers has previously said that the funding raised from the tax should not simply all be used to offer grants towards bills. The think-tank, like many other green groups, is advocating on greater investment in home insulation and a mix of clean energy solutions.

What wasn’t included in Sunak’s speech?

The Treasury has ruled out restoring the £20 uplift in the weekly amount available to claimants of universal credit at this stage. It has been reported that the Conservatives are concerned that any increase now would become permanent and that this has not been budgeted for.

For now, plans to reduce or remove VAT on energy and fuel have been shelved. This change may still be made at the Autumn Budget.

As expected, there was also no mention of new funding for a UK-wide home retrofit and insulation scheme. This has been much-recommended by green groups. Last month’s Energy Security Strategy was dubbed a “missed opportunity” to improve energy efficiency measures by many key green economy groups.

Sunak said that reforms to levies on electricity and gas bills “will take time” to complete.

Please login or Register to leave a comment.