Register for free and continue reading

Join our growing army of changemakers and get unlimited access to our premium content

McKinsey notes the importance of businesses being able to pivot towards low-carbon opportunities

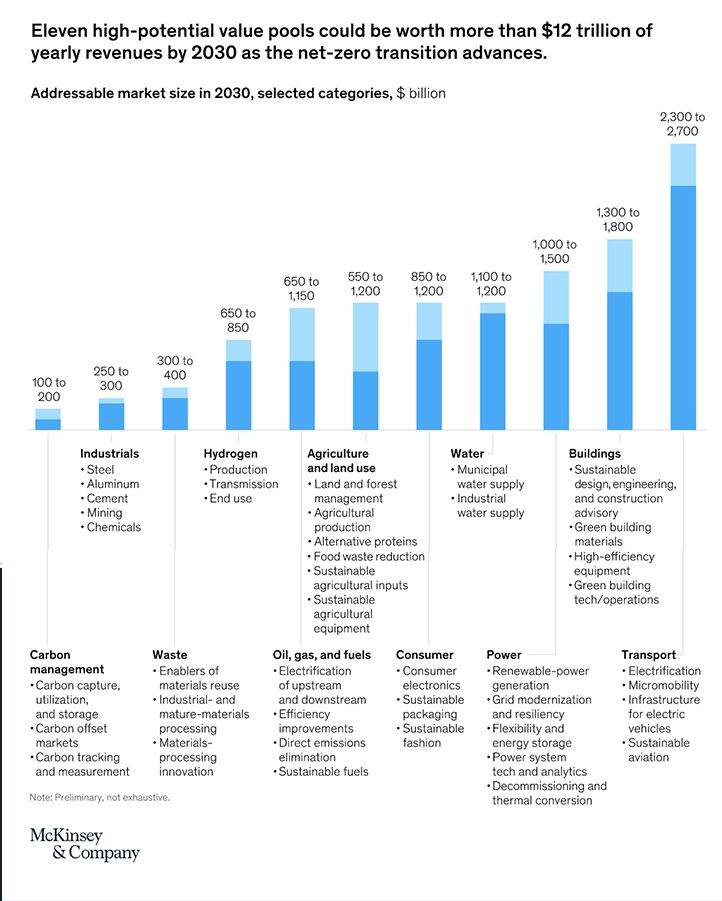

New research from McKinsey has outlined how more than two-thirds of global capital flows could be reallocated to low-carbon markets and services under a net-zero pathway transition, meaning that some 11 “high-potential” value pools could be worth between $9trn to $12trn in yearly revenues by 2030.

These value pools include sectors like power, transport and the built environment, processes like waste and land management and interaction with consumers.

According to McKinsey, businesses can be at the forefront of this economic shift, with around 70% of annual capital spending sifting into low-carbon markets by 2050. While organisations will have to spend up front of low-carbon solutions like renewables and circular models, the analysis notes that businesses can benefit by being early movers.

“For years, many large companies have responded to the prospect of a net-zero transition by playing defence—protecting their cash flows with sustainability programs that address regulatory mandates and the basic expectations of shareholders and nonfinancial stakeholders,” the analysis states. “But the reallocation under way to achieve net-zero goals will spur booming demand for climate-friendly goods and services and the green energy, equipment, and infrastructure needed to produce them.”

McKinsey notes that many businesses can pivot into industry segments that offer major growth potential, such as car manufacturers focusing on electric vehicles (EVs) – Ford is already separating its EV business – and oil and gas majors branching out into ventures such as hydrogen. As the net-zero transition takes shape, businesses will also be able to enter new markets, such as EVs being utilised for storage mechanisms, and using their low-carbon services as a differentiator that makes them stand out and gain market share.

The most profitable opportunities, the report notes, have emerged in fast-growing, niche markets like recycled plastics and meat substitutes, where margins can be 15% to 150% higher.

Businesses that move early in these sectors are reaping the benefits, with the analysis noting that “first movers are gaining the upper hand by using low-cost green financing to build out carbon-free production capacity and fill big, recurring orders for scarce commodities such as green steel or recycled plastics”.

Transition uncertainty

However, the analysis warns of “transition uncertainty” meaning companies will need to be more agile in order to pivot as emerging markets and solutions gain traction.

While low-emission assets like renewables and low-carbon transport cold unlock up to $3.5trn in annual spending, an additional $1trn currently going towards high-emission assets could also be relocated. This also means that the likelihood of stranded assets becomes much higher, and many businesses will need to look to see what projects are being built into their balance sheet and whether they’ll be viable in a net-zero economy.

Companies will need to develop “strategy under uncertainty”, the analysis states, warning that “no single formula” will work for every company.

Indeed, leading businesses will need to look at the “granular level of industry subsegments and fund growth initiatives” that sees them prioritise spending on these areas over more traditional, yet higher carbon initiatives.

The benefit of doing so, according to the analysis, is that businesses can charge a premium for more sustainable products and services, due to high demand from consumers. McKinsey notes that some businesses focusing on these solutions have seen sales grow 50% faster, compared to competitors.

This will, however, need to be supported with “transparent, independently verified information”, to negate the threat of greenwash. These include environmental product declarations (EPDs) and life cycle assessments (LCAs).

Please login or Register to leave a comment.