How ambitious are you being with your practices and could organisational mindsets be hindering these ambitions?

The link between sustainable business practices and strong financial performance is now widely recognised and accepted. It has led to increased focus on environmental, social and governance (ESG) practices among the business community in recent years. You may already have an ESG framework in place, indeed over half of FTSE 100 companies now have ESG committees. But how ambitious are you being with your practices and could organisational mindsets be hindering these ambitions?

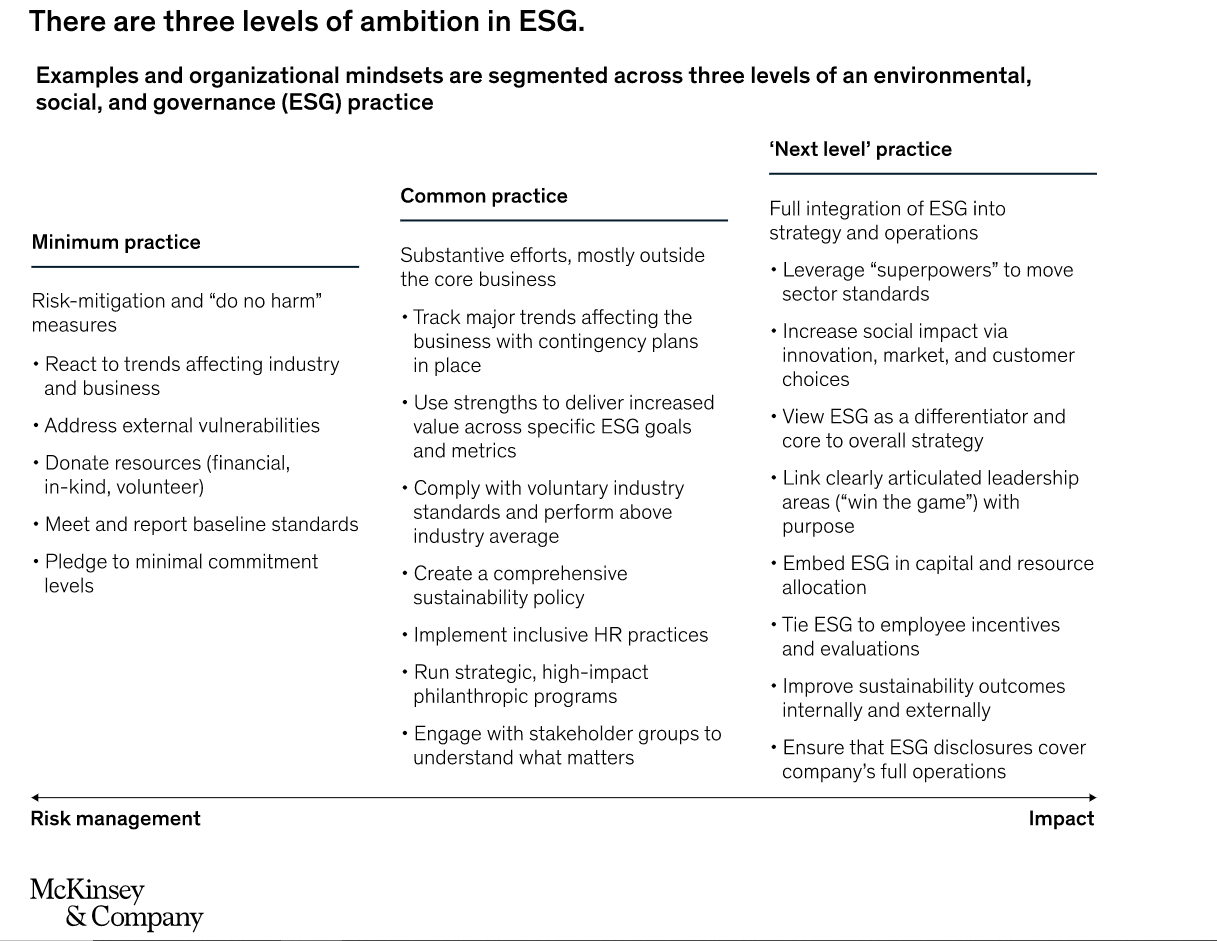

In their recent article ‘How to make ESG real’, McKinsey & Company argue that a company’s approach to ESG typically falls into one of three levels of ambition: minimum practice, common practice and ‘next-level’ practice. Those doing minimum practice are largely focused on risk management measures, while those carrying out ‘next-level’ practice are creating far more impact.

Image Source: Mckinsey & Company (2022) How to make ESG real

But should risk management and impact be the only ambitions for ESG? And are they sufficient motivations for organisations to take innovative action? If not, could this be why many companies are still only doing the minimum on ESG to mitigate risk, rather than being more forward-thinking?

Risk management is important, yes. Impact is very important, of course. But the benefits of ESG are being narrowed considerably within this narrative. The most important factor for companies throughout the centuries has been: opportunity.

Viewing ESG as an opportunity to create monetary and social value, as well as managing risk and delivering meaningful impact, offers a far more attractive reality for businesses. Opportunity can help inspire creativity and innovation. So, companies must start shifting to a mindset that embraces risk management, impact… and the opportunity to create shared value.

Sustainability as simply risk management

Taking the environmental pillar of ESG, undoubtedly the most leveraged by companies, adding ‘opportunity’ can really shift the narrative to better reflect its untapped potential.

It is understandable why the business narrative around sustainability has focused on risk-management for so many years, and why so many companies are still relatively unambitious in their thinking. Gloomy stats and figures have transfixed business leaders. Scientists, conferences, and report after report have given them an ultimatum: change or face extinction.

Has this narrative around change been communicated well enough to spur an effective and long-lasting transformation in the business community? In terms of managing risk, you can argue it has.

By now almost all business leaders are all too aware of the risks associated with climate change. Choose any company website, 99.9% of the time it will have a section dedicated to sustainability and their actions to reduce the risks of environmental damage.

But is this enough?

Of course the risks of environmental degradation must be considered by every business, but this narrative has been around for decades and has barely inspired the innovation and entrepreneurism needed to come up with ways to tackle it.

Sustainability as risk management, impact…and opportunity

How does that old saying go? Where there is risk, there is opportunity. Identifying risks and opportunities have been central to business and investment strategies for decades, and this should be no different in relation to the environment and sustainability.

For too long, sustainability managers and CEOs have found themselves in a crossfire between delivering competitive goods and services on the one hand, and responding to environmental consumer awareness and policy goals on the other. This outlook has kept sustainable development as an elusive concept. We must stop framing sustainability as a challenge, and start seeing it as an opportunity for shared value creation.

As Paul Polman, former CEO of Unilever, points out in his book Net Positive: How Courageous Companies Thrive by Giving More Than They Take: “Given the scale and urgency of climate change, combined with the moral imperative of tackling inequality and the array of SDGs – the quarterly-focused, shareholder-first mantra is incredibly unfit for purpose. The role of business is to address issues in society, so businesses should profit from addressing the world’s problems, not creating the world’s problems.”

Addressing these challenges presents the greatest economic and social opportunity of our time. We simply cannot get from where we are in the present, to an environmentally, socially, and economically sustainable future, without an historically unprecedented amount of innovation. From technology, building and transportation to agriculture and green finance, the future of business opportunity firmly lies in the ways we adapt and mitigate environmental catastrophe. Studies have shown that meeting the UN’s Sustainable Development Goals could unlock trillions in value and create hundreds of millions of jobs this decade. Innovative companies are already realising the masses of opportunity, whilst still delivering meaningful impact and managing risks.

Just some independent examples of the innovation and value created when opportunity is at the forefront include:

- Mars and Futerra launch ‘sustainable’ cat food made from insect

- Allbirds trainers are now labelled by their carbon footprint

- Ørsted’s green energy transformation

Unlock your company’s potential

Forward-looking companies are taking the lead on ESG and its associated opportunities for creating shared value. The benefits of implementing, engraining, and proactively undertaking corporate responsibility, sustainability, and ESG considerations within your organisation are obvious. It is no longer a nicety or a tick box, but an opportunity to be embraced.

Get in touch to discuss how we can help your business unlock these opportunities.

N.B. The information contained in this entry is provided by the above supplier, and does not necessarily reflect the views and opinions of the publisher