Isobel Marshall, ESG Policy and Market Development Consultant, and Laure Davis, ESG and Sustainability Consultant at DNV explore how businesses can set up the right internal structures to improve business strategies.

Businesses are facing increased pressure and expectation to acknowledge and act on environmental, social and governance (ESG) topics relevant to their operations and stakeholders. More specifically, organisations are urged to adopt a ‘double materiality’ approach. This means considering not only how a business may be affected by external factors, but also the impact it creates for its stakeholders, society, and the environment in which it operates.

Senior leadership, in particular, faces pressure to get this right. Materiality assessments play a crucial role in this process by identifying the most important, or material, topics relevant to a business’s long-term success. Strong materiality assessments are those that see active involvement of senior leadership and are not left simply to sustainability managers.

Why should senior leadership get involved?

Senior leadership buy-in is fundamental for a strong materiality assessment. This is because senior leaders (i.e., executives and board members) understand the business’s purpose and values and make strategic decisions on business direction and resource allocation. If they do not understand the company’s stakeholders and how ESG topics impact them and the business, they may be lacking key knowledge to create and maintain value. By having this knowledge and incorporating it into strategic and tactical decision-making, senior leaders are able to reduce risks and seize opportunities, delivering a more sustainable business, with reputational and operational benefits, as well as greater access to capital.

Without senior leadership involvement in materiality assessments, the results of the assessment are likely to be unclear, not wholly reflective of internal and external perspectives, and run the risk of being used as a reporting tick-box exercise. There are also severe reputational risks associated with a lack of senior leadership involvement in sustainability strategizing. Recently, there have been several litigation cases holding board executives personally accountable for their lack of demonstrable effort in addressing ESG issues. These highlight the increasing scrutiny that senior leaders face if they neglect their businesses’ ESG performance. Without senior leadership buy-in, materiality assessment results are unlikely to feed into strategic decision-making, increasing risks for businesses and failing to grasp emerging opportunities.

How can senior leadership get involved?

In order to maximise value and fully support the materiality process, senior leadership should be involved in the assessment process from the beginning to end. Ideally, senior leadership should:

- Sponsor the materiality project – this can be achieved by creating a working group or steering committee. The involvement of senior leaders from the get-go of an assessment can generate better and more engaged responses from stakeholders throughout the organisation by providing an increased level of trust and transparency for the assessment process.

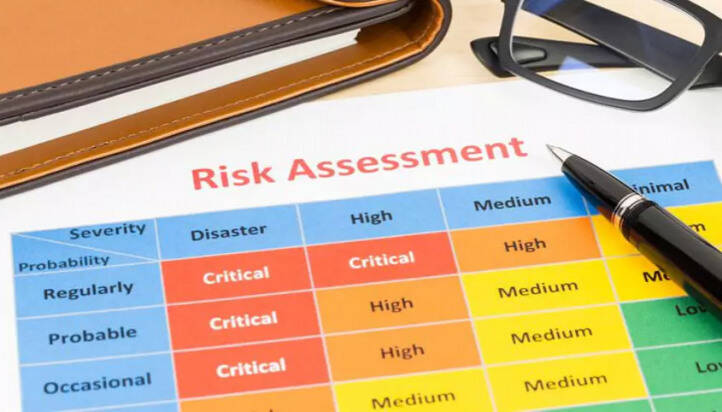

- Be involved at all stages of the assessment process, including- Planning of the materiality assessment – to help ensure that the material topics identified and surveyed are aligned with the business’s strategic aims and Enterprise Risk Management (ERM) scoring criteria, as well as identifying whose perspective will be most valuable to the assessment.

- – Delivery – senior leadership involvement in the delivery of the assessment can enable a deeper understanding of the outputs and impacts on the business, ultimately resulting in a more comprehensive and valuable assessment with actionable results.

- Furthermore, senior leaders should ensure the outputs of the materiality process are appropriately incorporated into governance, including business-wide strategy, risk management and investment decisions. Alignment to the business’s core strategy, values, and operations will enable the business to better navigate emerging ESG risks and opportunities.

By Isobel Marshall, ESG Policy and Market Development Consultant, and Laure Davis, Sustainability and ESG Consultant

N.B. The information contained in this entry is provided by the above supplier, and does not necessarily reflect the views and opinions of the publisher