Register for free and continue reading

Join our growing army of changemakers and get unlimited access to our premium content

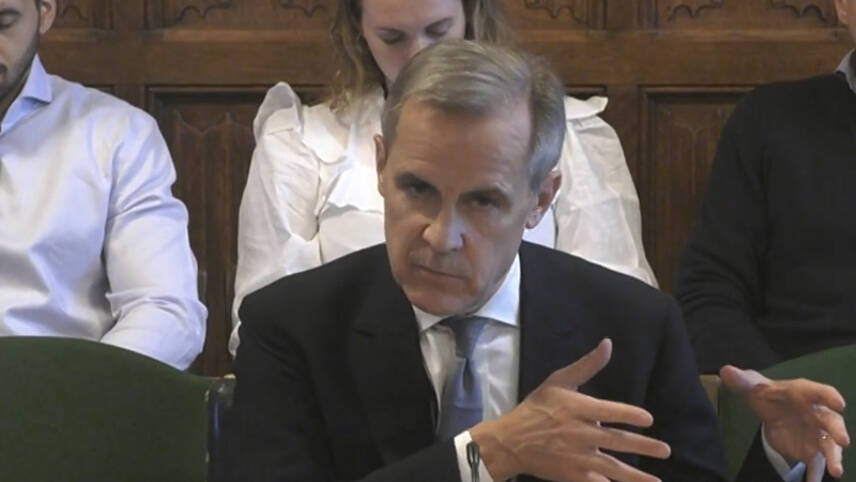

Image: Parliament Live TV

Carney was in the UK Parliament on Monday (24 October), providing MPs on the Environmental Audit Committee (EAC) an update on the Alliance, a year on from its launch during COP26 in Glasgow. The Alliance is touted as the largest of its kind, having started with representatives covering $130trn and since grown to cover $150trn.

From the outset, GFANZ has faced questions around the credibility of its commitments. It has been asked what it will do to prevent members from financing high-emission sectors such as coal, beyond the 1.5C temperature pathway, and whether members will be required to set science-based emissions goals as interim milestones in their long-term net-zero visions. It has also been pressed to clarify accounting for emissions from nature and land-use.

These concerns were put to Carney by MPs. He also faced questions about more recent turbulence surrounding GFANZ.

In recent weeks, news outlets have reported that institutions including BlackRock, the Bank of America, Vanguard, JP Morgan Chase and Morgan Stanley are considering leaving GFANZ – or even that they have already done so. The cause for this reported rift in the Alliance is that these firms are concerned about legal risks regarding to antitrust and competition laws, over the financing of fossil fuels.

Responding to these reports, Carney said: “a, they have not left, and, b, they have not indicated to me any intention to do so”

“I put more weight on conversations I’ve had with CEOs of institutions than unsourced things I read in the press, which then get repeated by others.”

Carney stated that the nature of voluntary collaborations like GFANZ means that members can leave and the initiative can continue. He added: “if somebody leaves, and if they do so because they believe the commitments are too stringent or they don’t want public scrutiny… then, they are answerable to that”.

Carney also denied reports that the GFANZ “re-worded” its recommendations on fossil fuel finance to prevent firms – specifically large US-based firms – from leaving. He said the initiative has, instead, provided more clear information on potential legal risks from participation.

Also this season, GFANZ saw two pension funds leaving its collaboration. Australia’s Cbus and Australia’s Bundespensionskasse departed, stating that data tracking and reporting requirements were too complex and would require too much resource.

Carney acknowledged that the financial world is “in a period of time of data development” around climate topics and that this will be a “difficult” process. He emphasised the importance of collaboration to collect meaningful and comparable data and noted how good data is a necessity to enable the sector to properly track its progress – and for leaders and laggards to be identified.

Greenwashing debate

To the leaders and laggard point, Carney was asked by Caroline Lucas MP and others why the GFANZ had not imposed stricter requirements for members to increase exclusion and divestment policies for high-emission activities. Lucas argued that most of the largest GFANZ members are still supporting coal, with an even greater majority still supporting oil and gas.

Carney said: “I’m on the record, along with the co-chair of Bloomberg, that in terms of coal, deforestation, and also oil and gas, that yes, they [financial firms] should [have specific policies].

“I would then say, though, in terms of the specifics of financing in conventional energy… that does not mean that every one of these investments is right or consistent with the transition. I will point out, though, that in the IEA and IPCC’s 1.5C scenarios… that the financing flow in conventional energy – oil and gas – somewhere between $600bn and $800bn.

“That’s what it takes to keep lights on and heat homes, given the existing energy system.

“It would be great to flip the green switch overnight.”

When asked whether, by being members of GFANZ, firms could greenwash, Carney pointed out that the natural progression of the initiative should constitute a clamping down on potential greenwashing.

He said: “GFANZ was launched last year. The first returns of the institutions are just due now.

“Next year, we will get more of those returns, but we will also have those who did the first returns reporting progress against targets. And, we will start to see, I hope, institutions out-performing their targets. But, undoubtedly… you will see people who are lagging.

“Ultimately, you have to meet your Alliance commitments. I have no doubt that a very large number of stakeholders, including the employees of these institutions and also others, will be scrutinizing their performance.

“What every institution in GFANZ has to justify is what the flow of their activities is… and is that consistent with the 1.5C path. What proportion of their assets are consistent with solving the issue, and are they growing it?”

Please login or Register to leave a comment.