Register for free and continue reading

Join our growing army of changemakers and get unlimited access to our premium content

Pictured: Fiddlers Ferry power station in Warrington

The UK’s green policy landscape has been chaotic over the last 18 months. A High Court ruling deemed the Government’s Net-Zero Strategy unlawful and in response, a new Growth Plan, accompanied by a detailed Carbon Budget Delivery Plan has been issued to get the transition back on track.

The Climate Change Committee (CCC) has trawled through more than 3,000 pages of Government updates to provide its annual progress report on the net-zero transition, published on Wednesday (28 June).

The overarching message makes for grim reading; with the Committee’s confidence that the UK will meet its climate goals “diminishing” year on year. Indeed, projections for the UK to meet its 2030 goals under the Sixth Carbon Budget and to reduce emissions by 68% as part of the nation’s commitment to the Paris Agreement have “worsened since last year”.

The CCC cites a combination of delays that are creating delivery risks across all sectors.

While UK greenhouse gas emissions have fallen by 46% since 1990, the CCC claims that “credible plans” only exist for 25% of the required emissions reductions moving forward. These are plans that have funding, enablers and timelines in place. There are other parts of the economy that do have strategies and plans to decarbonise, but the CCC claims that 30% of the required emissions reductions through to the 2030s have risks attached, and policy updates are therefore required.

Plans are either “completely missing” or “currently inadequate” for 18% of the required emissions reduction.

Every sector will need to decarbonise if the UK is to realise the 68% reduction in seven years’ time. However, the CCC report suggests that the UK’s largest sectors have not been supported by enabling policy frameworks to deliver this transition.

Here, edie dives deep into the CCC’s data to uncover what sectors, if any, are on track to reach net-zero emissions.

Surface transport

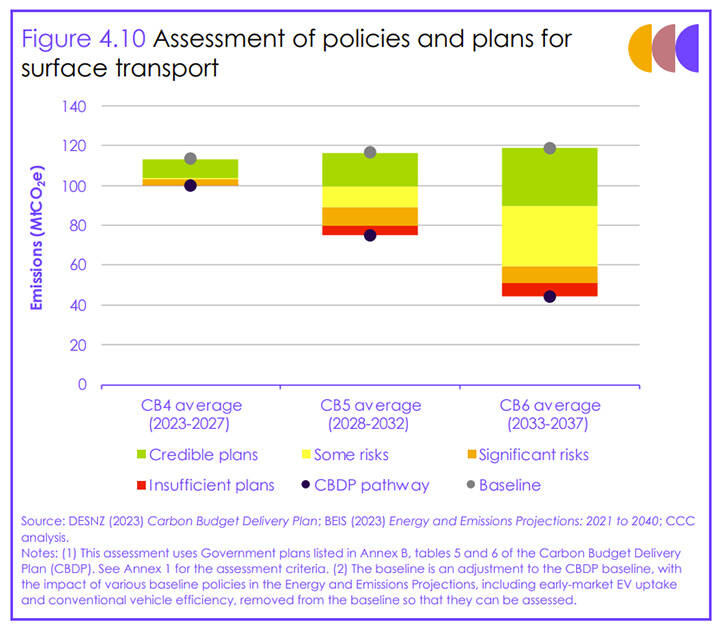

Accounting for 23% of UK emissions in 2022, surface transport remains the nation’s highest emitting sector. Plans laid out in the Government’s Carbon Budget Delivery suggest that emissions from the sector will need to be reduced by 61 MtCO2e by 2030, equating to a 58% reduction.

The CCC has little confidence that those reduction levels will be met based on current policies. The CCC has also expressed concerns that the reduction targets laid out in current Government plans would “results in an abatement shortfall which will need to be made up to meet legislated carbon budgets”. Essentially, even hitting the 58% reduction would not put the sector on course to reach net-zero.

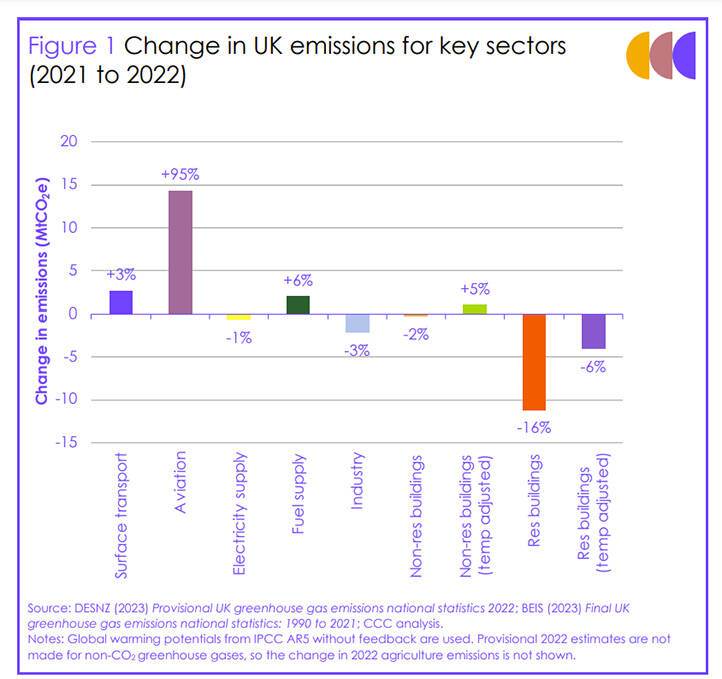

Surface transport emissions actually increased by 3% last year, but are still 8% below pre-pandemic levels recorded in 2019.

The CCC notes that policy progression in this sector has been “slower than expected”. As such, it is estimated that there are only “credible” policies in place to meet 38% of the required emissions reductions up to the mid-2030s and the Sixth Carbon Budget.

The report does welcome that the market share of electric cars continues to increase ahead of the CCC’s net-zero estimates. Additionally, the UK’s electric vehicle (EV) charging network expanded by almost one-third over the past year. The CCC does stress that risks remain about the “inconsistent” availability of chargers across the country.

The main policy ask from the CCC in this sector is to confirm the details of the ZEV mandate for 2024. The Government confirmed in 2022 that a mandate would be introduced that required auto manufacturers to produce a certain amount of zero-emission cars and vans. The CCC wants the mandate to drive the growth in EVs sales while enabling the UK to meet its 2030 phase-out for new diesel and petrol vehicles.

The CCC notes that the development of the ZEV mandate is “tight” and that the start date of 2024 could be missed. It adds that the Government should develop the “appropriate regulatory mechanism for HGVs” as soon as the ZEV mandate had been legislated. The Government’s response to the consultation on ending the sale of new non-ZEV buses is now overdue, the report adds.

Finally, the report notes that the Government has not responded to the CCC’s recommendation on clarifying the role of car demand reduction in enabling decarbonisation. The number of kilometres driven by road vehicles was 21% higher in 2022 than in 2020 as a result of lockdowns ending and remain 5% below pre-pandemic levels.

Electricity supply

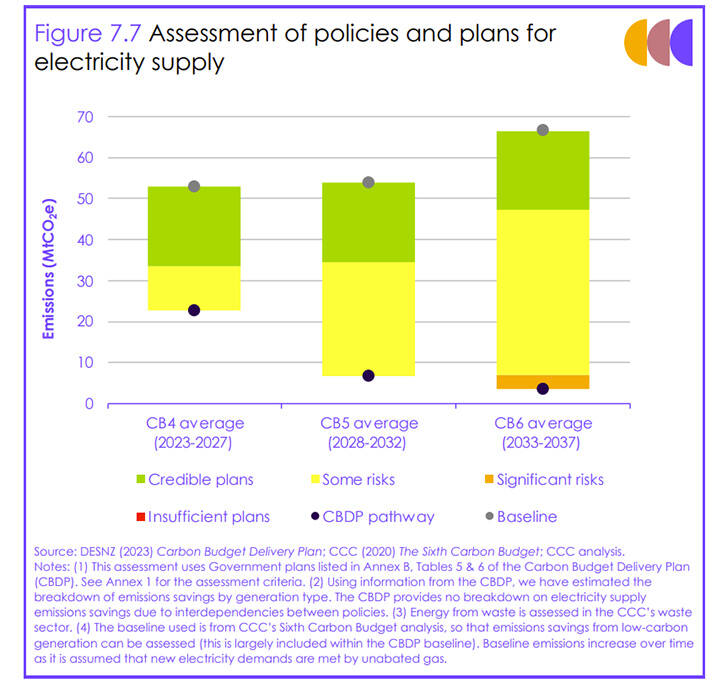

The UK’s electricity grid and generation accounted for 11% of UK emissions last year and the Government is targeting a 44 MtCO2e decline in emissions from this sector to comply with the Sixth Carbon Budget.

Grid decarbonisation is the foundation of the net-zero movement and the UK has made notable strides in this area. The emissions intensity of UK power generation decreased by 7% last year and low-carbon sources accounted for 56% of electricity generated in 2022, 9% higher than 2021 levels. The CCC attributes this mainly to the wind sector, which saw generation reach a record 80 TWh, up 24% on 2021 because of a 12% increase in capacity.

Provisional estimates suggest that electricity supply emissions fell by 1% in 2022 compared to 2021 despite a rise in total UK electricity generation. The UK was a net exporter of electricity for the first time in recent history.

While progress has been strong, the CCC found that credible plans are in place for around 30% of the emissions reduction required by the Sixth Carbon Budget period.

The main stumbling block, according to the CCC is that the Government is “lacking a credible overall strategy” to deliver its goal of fully decarbonising the sector by 2035. The report calls on policymakers to publish a comprehensive long-term strategy for this goal, that outlines how low-carbon flexibility options, including demand flexibility, storage, hydrogen, gas CCS and interconnection capacity, will all play a role.

The CCC has been calling for such a strategy since 2020 and the calls have been echoed by the National Audit Office and the House of Commons Business, Energy and Industrial Strategy Select Committee. The report states that a strategy should ideally be published this year.

The report also notes that a “portfolio of dispatchable low-carbon capacity” such as gas combined with CCS and hydrogen is “essential for a resilient, low-carbon electricity system” and believes that 3-6GW of capacity will be necessary by 2028. The CCC does state that the Government is “on track” in this area, with at least 7GW of dispatchable low-carbon capacity in development currently.

The UK is also on track when it comes to grid storage and active demand response, with the CCC’s modelling claiming that active demand response will need to reach 2-3% of total demand by 2028.

Other key recommendations include identifying “low-regret” electricity and hydrogen infrastructure that can be developed now, new frameworks for local, regional and national planning systems involving Ofgem and to create a Minister-led infrastructure delivery group, advised by the new Electricity Networks Commissioner, to ensure enabling initiatives for energy infrastructure build are taken forward.

Industry and business

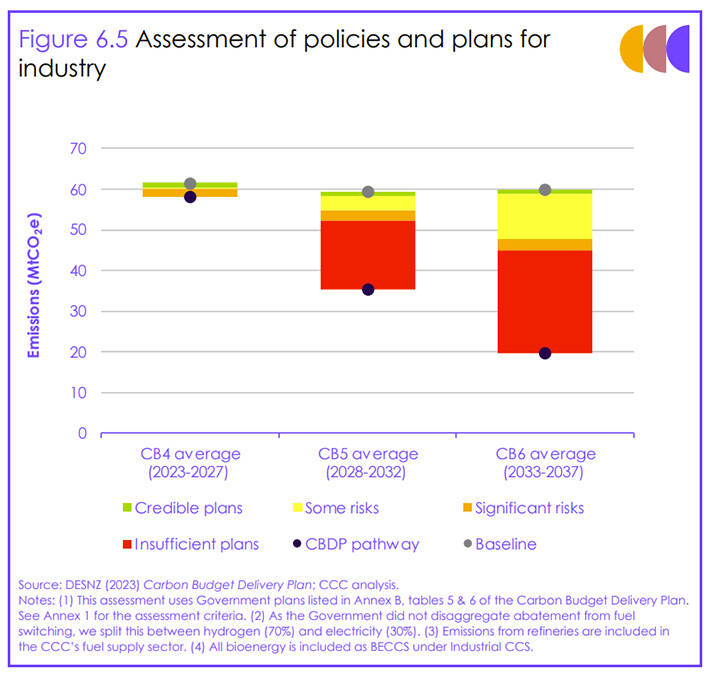

Industrial emissions accounted for 14% of UK emissions in 2022 but did fall by 3% year-on-year to 63 MtCO2e. The CCC attributes this to a decline in manufacturing output, which fell by 4% between 2021 and 2022.

While the sector has consistently reduced emissions over the last decade, a large portion of the reduction is accounted for by the grid becoming greener, and more emphasis is needed on getting businesses to decarbonise.

The CCC warns that plans are either “insufficient” or have “significant risks” for 70% of the required emissions reduction by the Sixth Carbon Budget period.

The report notes that industrial decarbonisation will need to speed up drastically. The Government’s delivery plan targets a 69% in emissions reductions by 2035 relative to 2022 levels, meaning an annual decline of 8% between now and 2030.

Two main risks are highlighted by the CCC. The first is that of carbon leakage, where manufacturing and production will relocate to countries with fewer restrictions on emissions, which won’t help with wider decarbonisation. Additionally, companies may start to overlook the UK in favour of nations that provide greater support on decarbonisation. The CCC cites the US Inflation Reduction Act and the EU’s proposed Green Deal Industrial Plan as two competitive frameworks.

The report also found that the Government’s delivery plans rely less on energy efficiency and more on carbon capture and storage (CCS) than what the CCC advises. The Carbon Budget Delivery Plan sets an annual average abatement in the industry of 6.6 MtCO2e from CCS, compared to 5.3 MtCO2e in the CCC pathway.

However, the CCC warns that there are ‘insufficient plans’ for most of the abatement projected in the Fifth and Sixth Carbon Budgets.

While the Government has announced up to £20bn for CCS projects over the next 20 years, the CCC warns that there is little to no support to help industrial processes switch to electrification and “little evidence that industry is preparing to electrify at scale”.

The report also claims that policy is failing to target dispersed sites away from industrial clusters. A £5m initiative has been launched in this area, but the CCC says much more is needed. There is also no clear strategy for decarbonising small facilities not covered by the UK ETS, which represent around 40% of industrial emissions. The CCC is calling for clear incentives for facilities not covered by the UK ETS to decarbonise.

Indeed, there is a disparity in industrial emissions between those covered by the ETS and those not. Emissions by those covered by trading schemes have fallen by 30% between 2012 and 2021, compared to 27% for those outside of the schemes.

The CCC also calls for a strategy and timeline to decarbonise the iron and steel sectors.

The CCC also warns that supply chain emissions, regardless of where they occur, need to be tackled. While the Committee has welcomed the increased trend of corporates setting net-zero and science-based targets, it has stated that meeting these goals will still fall short of it’s mapped pathways for net-zero.

If manufacturing companies analysed by the CCC were to meet their climate goals, it would result in a reduction in emissions equivalent to 32% of the reduction in the CCC Balanced Pathway by 2030, and just 19% by 2050.

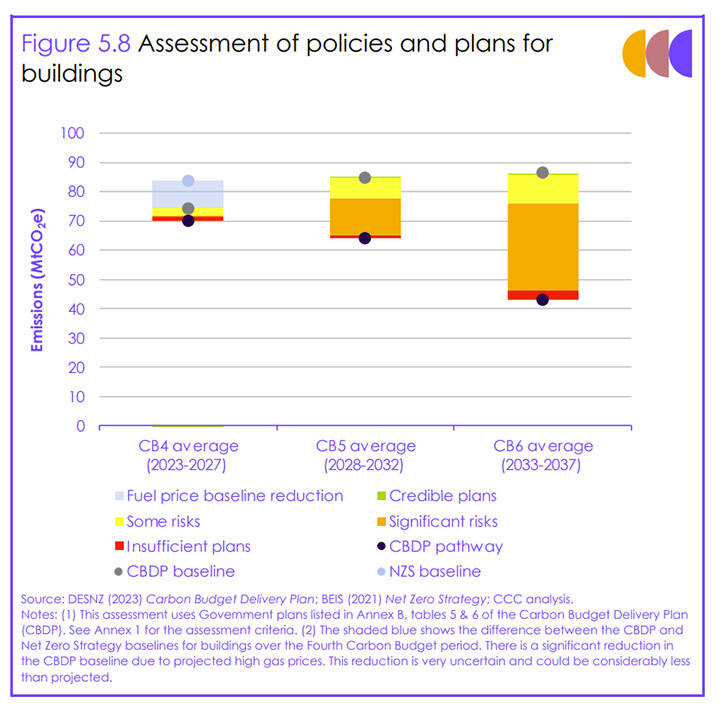

The Built Environment

Accounting for 17% of UK emissions in 2022, the built environment is second only to surface transport when it comes to high-emitting sectors.

The Government’s delivery plans state that emissions from the sector will need to be reduced by 33 MtCO2e by 20230, a 43% decline.

The industry is suffering from more than a decade of stagnation. Territorial emissions from the sector peaked in 1996 and even fell by 15% in 2008, but progress has largely flatlined since. On the surface, progress in 2022 looks promising. Residential buildings emissions fell 16%, primarily due to mild winter months, with a smaller contribution from record high fuel prices reducing demand. When adjusted for temperature, emissions from residential buildings emissions fell by 6% in 2022, significantly more than the annual average of 1% from 2010-2019, but the CCC claims that high gas prices will have deterred many users and has therefore disproportionality impacted emissions.

The CCC report claims that “progress remains broadly insufficient to ensure that the buildings sector reaches zero emissions by 2050”, with 77% of the required emissions reductions to meet the Sixth Carbon Budget either class as “at significant risk” or “with insufficient plans”.

The report welcomes the “thousands of measures” that the Government is implementing to transform the sector through the Heat and Buildings Strategy, but states that policymakers “continues to avoid big, impactful decisions and action” that is putting future carbon budgets at risk.

The CCC has listed a plethora of policy asks to get the sector back on track. Firstly, the CCC welcomes the Government’s target to deliver a 15% decrease in final energy demand from buildings by 2030, but states that there are no guidelines or mechanisms for how this will be achieved. As such, the UK is significantly off-track to meet this aim, with the CCC actually stating that a 20% target is better aligned with net-zero while still being feasible.

The CCC claims that the Government is vastly behind on efforts to decarbonise heat. The report found that the UK installed 72,000 new heat pumps in 2022, 69,000 of which were installed in homes – 40,000 of which were retrofits. However, the CCC’s advice called for 130,000 installations in 2022, rising to 145,000 in 2023. The UK is installing a little over half of what is required on an annual basis.

The CCC adds that the cost of installing a heat pump in a home fell by 1.9% in 2022. This followed sharp rises in 2020 (10.3%) and 2021 (19.2%). It also welcomed the extension of the Boiler Upgrade Scheme (BUS) to 2028, which could deliver around 180,000 heat pump installations over the period to 2028.

The CCC also called for the Government to unveil details of the Clean Heat Market Mechanism as soon as possible, ahead of a scheduled rollout next year. The Energy Security Bill also needs to be passed.

The report also notes that the Government has failed to provide clarity or inspire confidence in the role of hydrogen in decarbonising heat. The Government is planning to make a “strategic decision” on its role in 2026, based on feedback from trials such as the hydrogen-powered villages. “A lack of Government visibility and engagement is undermining public confidence and increasing the risks of project failure,” the report notes.

The CCC also condemned the Government’s “insufficient” retrofits for fuel-poor households and residents of social housing. A consultation on the 2025 Future Homes Standard has also been requested.

The CCC also calls for the scope to be narrowed by the Government to affirm that “electrical heat is the default option in all new buildings and existing properties off the gas grid” while also “prohibiting connections to the gas grid for new buildings from 2025”.

On public sector buildings, the CCC notes that committed funding up to 2025 such as the Public Sector Decarbonisation Scheme (PSDS) will comprise up to 80% of what is needed to meet the Government’s target to reduce public sector emissions by 75% by 2037. However, there is no policy commitment beyond 2025 and the CCC is calling for a “significant ramp-up in investment”.

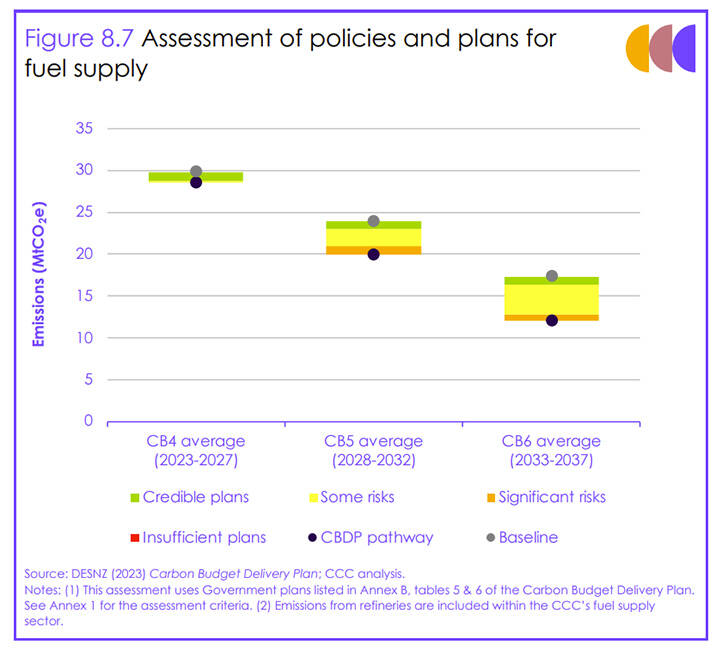

Fuel supply

The UK’s fuel supply accounted for 7% of total emissions, predominantly deriving from fossil fuel supply. The Government is targeting a 21 MtCO2e reduction in emissions from the sector to comply with the Sixth Carbon Budget.

Given that the UK is still debating whether to approve its first deep coal mine in more than 30 years and that the Energy Security Strategy committed to an increase in North Sea oil and gas production, it is hardly surprising that the CCC has downgraded its forecasts for the sector.

Indeed, fuel supply emissions increased by 6% in 2022, largely due to increased oil and gas production as a bounce back from the pandemic. Fuel supply emissions are still 11% lower than pre-pandemic levels, however.

The CCC warns that credible policies are in place to meet only 17% of the required emissions reduction by the Sixth Carbon Budget period.

In response to new licensing for oil and gas, the CCC reiterates it stance that new production would have a “marginal at best” impact on prices and insists that reducing fossil fuel reliance is the best course of action.

The coal mine fiasco could also see the UK commit to generating emissions from coking coal, despite the CCC reiterating that there will be no domestic use after 2035 under a net-zero scenario. The mine will have a “noticeable impact” on emissions, the report adds.

The report also criticises continued delays to the Biomass Strategy and the lack of clarity of the Government’s hydrogen plans. The CCC claims that low-carbon hydrogen production will need to rise sharply to between around 40 and 120 TWh/year by 2030.

One final point to consider is that the Government’s own pathways for the sector are well below what the CCC recommends.

The North Sea Transition Deal commits the UK to reducing emissions from oil and gas by 50% by 2030 compared to 2018 levels. The CCC believes that a 68% reduction is feasible in order to deliver net-zero.

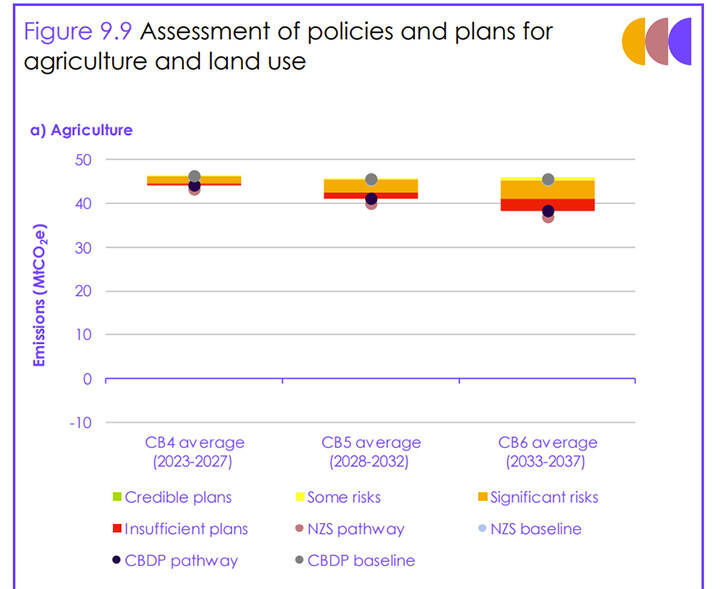

Agriculture and land use

Agriculture and land use accounted for 49 MtCO2e in 2021 (the last available data), an 11% share of the UK’s total emissions. This, the CCC notes, is an increase of 1 MtCO2e, because of increased agricultural emissions.

The CCC warns that there are either risks or insufficient plans identified against all proposed policies that the Government has signposted to deliver the Sixth Carbon Budget.

Baseline accounting and projections for this sector are messy at best, the Carbon Budget Delivery Plan sets out plans to reduce emissions in the agriculture and land-use sectors by 29% by 2035, compared to 2021 levels. But the CCC notes that emissions savings with respect to the baseline are now 32% less than what was set out in the Net-Zero Strategy prior to it being updated, suggesting a reduced appetite to decarbonise in the sector.

Additionally, the CCC warns that around a third of agricultural and land-use abatement solutions are “speculative technological and innovative measures that either have no supporting policies, are in development, or are highly dependent on market uptake”, which means they will likely not be adopted quickly enough to help reach net-zero. Agricultural abatement estimates as part of the Government’s new delivery plan are now 11% lower in 2035 compared to the 2021 Net-Zero Strategy, despite the baseline estimates remaining unchanged.

The main overarching challenge facing the sector is that it is still waiting on a comprehensive UK land use strategy. The Government committed to delivering a Land Use Framework last year and was meant to be published this summer. It has now been pushed back to autumn and no confirmed date is available.

The CCC wants the strategy to identify how land use can reduce emissions, sequester carbon, adapt to climate change, improve food security, biodiversity, domestic biomass production and deliver wider environmental goals.

Further delays in the strategy would “severely jeopardise the land sector‘s ability to become a net sink by the mid-2030s”, which the CCC claims is necessary in order to offset residual emissions from other sectors.

The CCC also notes that, despite recent policy announcements and funding, the UK is “falling substantially short” on its plans to restore and protect woodland and peatland, while the planting of energy crops also requires a dramatic increase.

The rate of afforestation for woodlands has not climbed enough since 2010. In 2022, a small increase to 13,900 was recorded, up from 13,300 the year prior. This is well short of the Government’s target of 30,000 hectares of woodland creation annually by 2025.

For peatland, The rate of restoration for the UK was 12,700 hectares in 2022/23, an increase of 3,800 hectares since 2021/22. The combined Government targets for England, Scotland and Wales require 29,000 hectares per year by 2025. Not only is the Government not hitting its own targets, but these targets are also well below the CCC’s recommended UK-wide rate of 67,000 hectares per year by that date.

The report also references that livestock numbers in the UK will need to reduce alongside reductions in meat consumption. Efforts and data collection also need to be stepped up in terms of food waste. The Waste and Resources Action Programme (WRAP) expect to publish the latest update later in 2023.

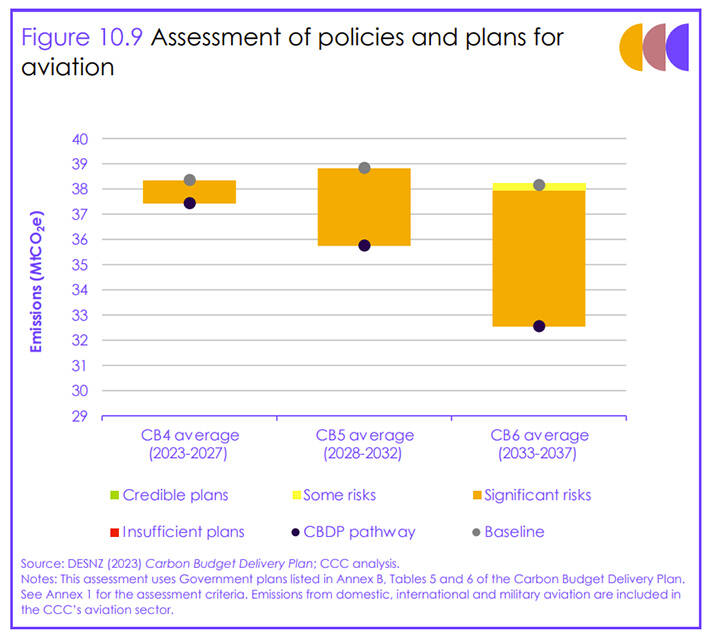

Aviation and Shipping

Aviation and shipping account for 10% of UK emissions, with aviation taking up the lion’s share. Indeed, aviation emissions reached 29 MtCO2e in 2022, a 95% increase in 2021, due to increased travel activities following the pandemic. It should be noted that this is still a 25% reduction on 2019 levels.

The CCC report notes that it is still “too early “ to say whether key targets around passenger numbers and travel distance to align with net-zero will be met. Overall, however, the report suggests that the sector is “not showing progress” that it can deliver decarbonisation through policy implementation.

The main policy piece for aviation is the Government’s Jet Zero Strategy, published in July 2022. The Strategy recommits to 70% passenger demand growth by 2050 on 2018 levels. Additionally, the Carbon Budget Delivery Plan suggests a 17% reduction in sectoral emissions by 2035, relative to 2019 due to the pandemic’s impact on emissions.

Other commitments include having five UK Sustainable Aviation Fuel (SAF) plants under construction by 2025. The CCC notes that the SAF mandate has been delayed and that “insufficient policy has been brought forward to address demand management”.

Indeed, the Government seems to be overtly reliant on “nascent technologies”, the CCC notes.

The CCC also reiterates the recommendations it published in its Sixth Carbon Budget Advice that no net expansion of UK airports should take place in order to keep the sector on the pathway toward net-zero.

Since first making that recommendation, airports across the UK have increased their capacities and continue to develop capacity expansion proposals. This is “incompatible” with the UK’s net-zero target, the report notes.

Specifically, the CCC states that no airport expansions should proceed until a “UK-wide capacity management framework is in place” to annually assess and, if required, control sector emissions.

As for shipping, which accounted for 3% of UK emissions in 2022, the report notes that “little has changed in the last year regarding policy for the shipping sector”.

Emissions in the sector rose 1% year-on-year, but are still 12% below 2019 levels. The Government’s Carbon Budget Delivery Plan requires emissions from domestic shipping and the UK’s share of international shipping to fall by around 22% by 2035 on 2019 levels.

The CCC notes that while the UK’s share of international shipping is included in the net-zero target, it will not be included in carbon budgets until 2033, during the Sixth Carbon Budget period.

While we wait, the report notes that Government will need to spend 2023 getting the sector ready for an orderly decarbonisation transition.

The CCC called on the Government to publish a response to the Course to Zero consultation and embed it in the updated Clean Maritime Plan, warning that without the Plan, there are “no credible policies in place” to meet the required emissions reduction levels.

The main focus for the sector is zero-carbon fuels, of which the CCC states there is “essentially zero” uptake. It also warns that while e- and bio-methanol is being adopted by some parts of the sector, it has concerns about the feedstock and sustainability of these alternatives, given that CCS technology is required to make it low-carbon.

The Conservative Government are spending 0.3% of GDP on the climate crisis and 0.4% of GDP on incontinence pants. Must try harder, they spend much more on nuclear weapons that they cannot use.

In the caption photo of cooling towers, it should, perhaps be pointed out that are emitting condensed water vapour from the cooling process. This has nothing to do with CO2 emission, the same cooling is needed by nuclear stations!