Register for free and continue reading

Join our growing army of changemakers and get unlimited access to our premium content

The research also found that brands in certain sectors are more likely to have sustainability act as a differentiator

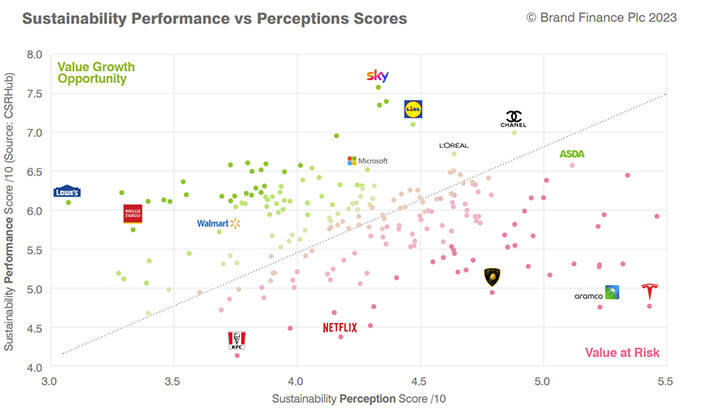

Valuation consultancy Brand Finance has released the Sustainability Perceptions Index, first launched at the World Economic Forum in Davos earlier this year. The Index examines the value that could be gained or lost by major brands based on the imbalance of their perceived and actual ESG performances.

Where sustainability performance exceeds perception, Brand Finance claims that there is an “opportunity to rapidly generate value, by communicating the brand’s genuine commitment to sustainability more effectively”. Conversely, the Index warns that where perception exceeds performance “value is at imminent risk, as brands leave themselves open to public backlash”.

The report found that many brand values remain largely untapped, by failing to align sustainability perceptions with actual performance and that better marketing and communications of their ambitious and transparent targets could act as a huge revenue driver.

Indeed, the Index claims that Microsoft, which is already carbon-neutral in operations and intends to halve emissions this decade and invest to offset and remove more carbon than it emits annually, has the “highest positive gap value” of any brand at $1.5bn.

Brand Finance claims that Microsoft could generate that sum of finance through enhanced communication of its sustainability initiatives and services.

The Index, which calibrates scores for brands based on data from CSRHub in conjunction with a Sustainability Perceptions Scores (SPS) methodology, warns that Tesla is one company at risk of losing billions.

The analysis claims that Tesla is perceived as a sustainable brand, due to the environmental components of its strategy. However, the company could be undermined by “weaker” action on governance and measures of social sustainability, which creates a value risk of up to $4.1bn, more than any other brand in the Index.

Amazon, despite its continued wrangles with staff over pay and climate action, has the highest perceived value based on sustainability of any brand analysed in the index. At almost $20bn, Amazon tops the index because “consumers appear to have confidence that it is committed enough to minimising impacts for them to continue to use its services”.

However, its actual performance score is much lower and the report warns that “if Amazon fails to keep pace through a precautionary approach to improving its sustainability performance, and honest communication about its progress, those billions of dollars of value could be at risk.”

Luxury fashion brand Chanel is an example of a brand that has both a high perception score and performance score, meaning that the company’s ambitions and actions have been accurately explained and communicated.

The research also found that brands in certain sectors are more likely to have sustainability act as a differentiator. Brands in the luxury automotive, soft drinks, supermarket and personal care sectors are more likely to be preferred by consumers based on perceived sustainability credentials than in tourism, technology and engineering, for example.

This is a brilliant article there was one recently posted on ESG investors talking about the 6 shades of greenwashing which discusses this!

Great video for marketing video on this as well for those who like a visual!

https://www.youtube.com/watch?v=UE-XDazXDpM